Measurement, on the other hand, remains an uneven playing field. CTV lacks the kind of universal tracking infrastructure found in browser-based environments. That makes campaign verification, tagging, and real-time attribution far more difficult to execute consistently.

All things considered, the market is unfazed.

GroupM’s mid-year forecast pegged global CTV ad revenue at $25.9 billion in 2023, with a projected CAGR of 10.4% through 2028. [3] This reflects growing interest from brands eager to align with the rise of ad-supported streaming and the shift away from linear TV.

Supporting this growth, Deloitte reports that two-thirds of consumers in developed markets now use at least one AVOD platform monthly—a 5% increase year over year. [4] The adoption of these ad-funded models reflects growing consumer openness to content monetized through advertising.

That said, visibility remains a major gap. According to a study by DoubleVerify and IAB Europe, only 30% of advertisers and publishers report full transparency into where their CTV ads run. Even more troubling, 27% rarely or never know whether placements meet brand safety standards. [5] Most CTV buys are still conducted through Programmatic Guaranteed or Private Marketplaces—limiting the scale and flexibility advertisers are accustomed to. [6]

Nonetheless, change is coming. Buyers who push for more accountability are helping accelerate the adoption of better practices—laying the groundwork for a more interoperable future.

On the performance side, signs are promising. According to Next TV, CTV ads tend to hold viewer attention more effectively than other digital video formats. [7] Still, this may have more to do with today’s lower competition and ad density than any intrinsic property of the format. Findings from SiriusXM Media add nuance, showing that CTV performance increases when paired with complementary channels like digital audio. [8]

Thinking ahead.

CTV’s future is undeniably bright, but sustainable success depends on more than its current momentum. To reach its full potential, the industry must move toward a more open, accountable, and scalable ecosystem. That includes reducing reliance on proprietary systems, embracing shared measurement frameworks, and building tools that empower advertisers to manage complexity with precision.

Among the most promising developments is the advancement of contextual intelligence. With third-party identifiers on the decline and household-level data proving limited, content-level understanding becomes essential. Contextual targeting offers a privacy-compliant path forward—especially in environments where user-level data is scarce or unavailable.

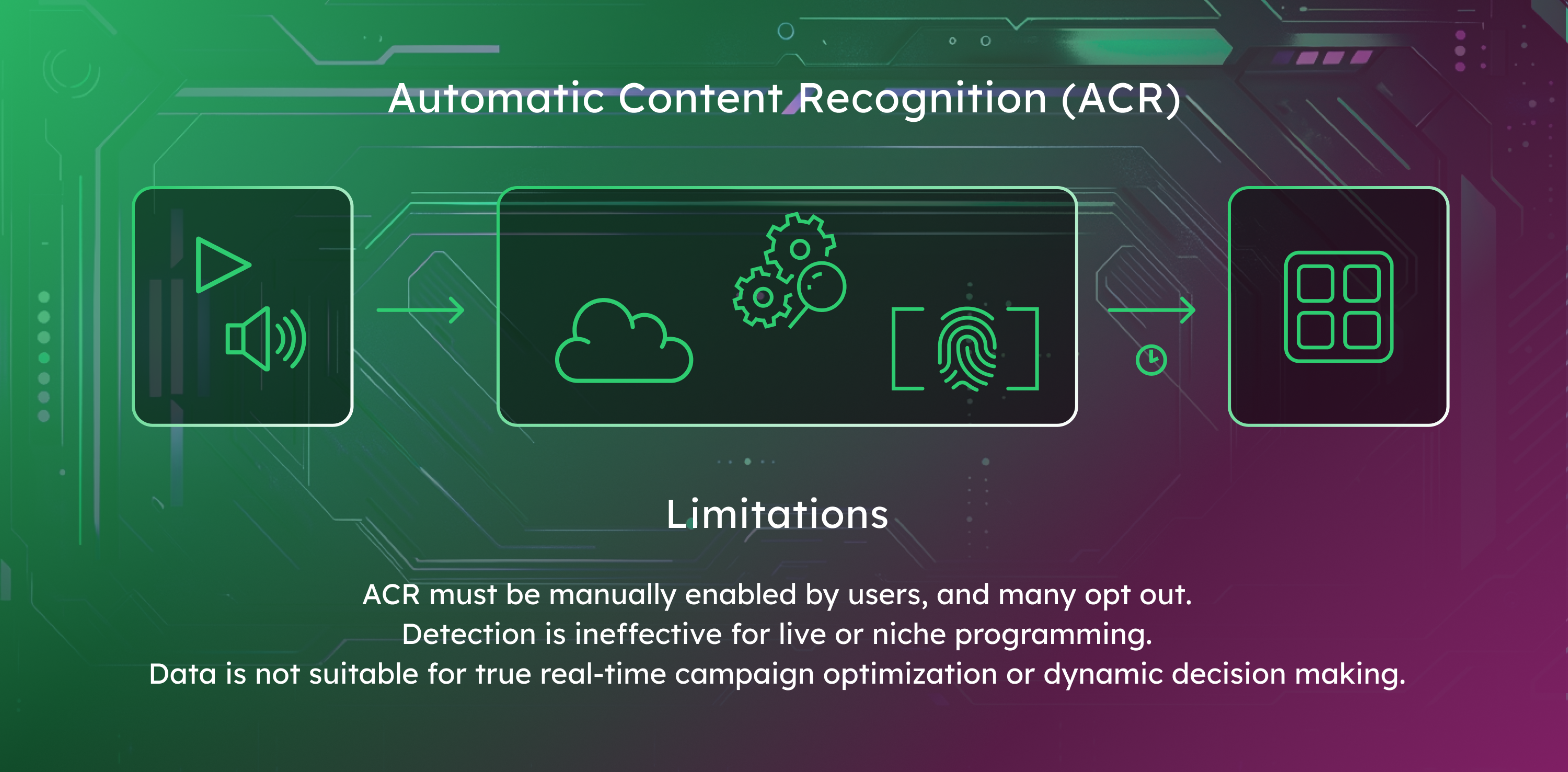

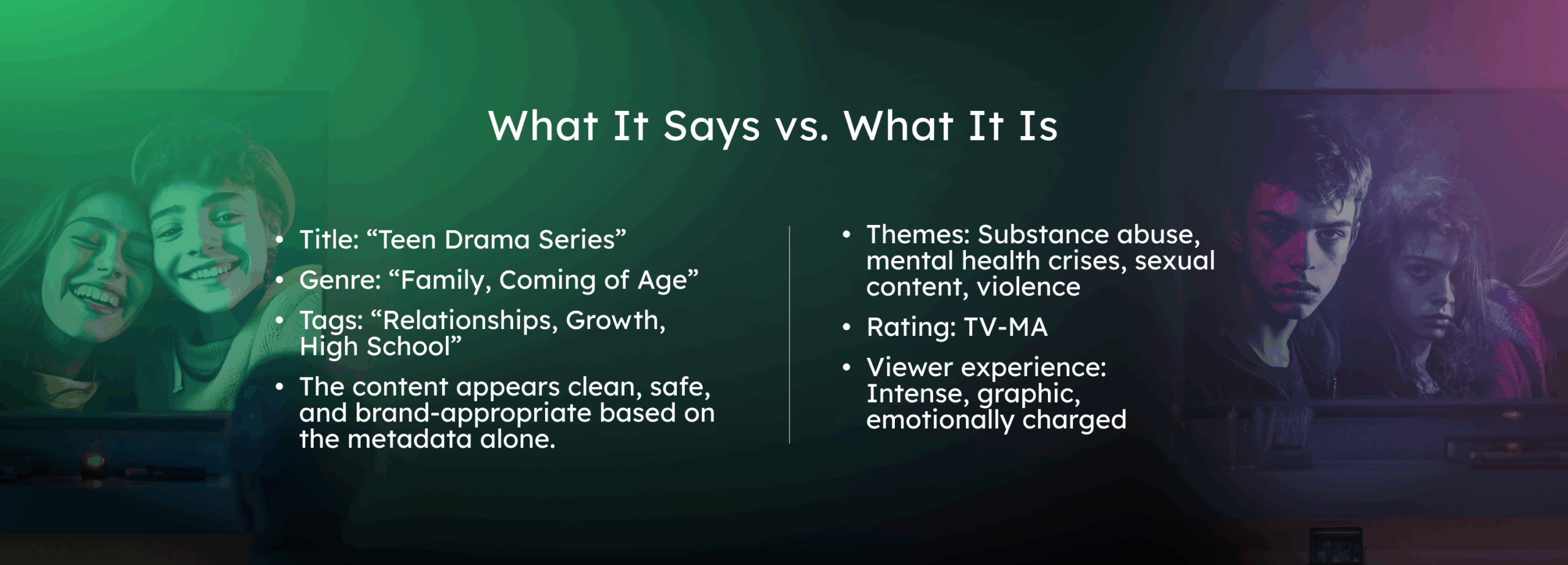

That said, video-based contextual tools are still playing catch-up. While text environments have benefited from years of semantic refinement, video content remains far harder to categorize with accuracy. Existing solutions like ACR and metadata scraping provide some visibility, but lack the consistency and granularity required for effective media planning. This is a clear area for innovation.

Building lasting trust in CTV also depends on improving transparency. Without shared standards for classification, verification, and performance, advertisers are left with fragmented views and limited control. Industry efforts from IAB Tech Lab and independent measurement providers are encouraging, but broader adoption remains essential.

Unlocking the full potential of CTV will take more than optimism—it demands smart strategy, real visibility, and solutions that deliver clarity around what’s actually being bought and where it’s being delivered.

Contextual targeting, while not without its limitations, represents a step in the right direction. Unlike black-box third-party audiences, it offers visibility into what’s driving targeting decisions. A recent Adlook study found that third-party demographic segments were inaccurate up to 43% of the time—meaning nearly half of impressions were mistargeted. [9] With contextual, advertisers may still need refinement, but at least they know what they’re working with—creating a foundation for optimization, learning, and long-term results.

Sources:

- Grand View Research – Global Video Streaming (streaming Media Industry) Market Size & Outlook: https://www.grandviewresearch.com/horizon/outlook/video-streaming-streaming-media-industry-market-size/global

- IAB – Content 1.0 to Content 2.0 Mapping Officially Released: https://iabtechlab.com/content-1-0-to-content-2-0-mapping-officially-released/

- eMarketer -Connected TV (CTV) ad revenue growth: What’s behind the surge?: https://www.emarketer.com/content/connected-tv-ctv-ad-revenue-growth-what-s-behind-surge

- Deloitte – Everyone’s watching: AVOD finds an increasingly receptive audience: https://www2.deloitte.com/us/en/insights/industry/technology/technology-media-and-telecom-predictions/2023/avod-trends.html

- IAB Europe – Transparency is largest obstacle in CTV reveals research from DoubleVerify and IAB Europe: https://iabeurope.eu/transparency-is-largest-obstacle-in-ctv-reveals-research-from-doubleverify-and-iab-europe/

- DoubleVerify and IAB – CTV in Europe: https://www.alliancedigitale.org/wp-content/uploads/2024/02/DoubleVerify-and-IAB-Europe-CTV-in-Europe-Report.pdf

- NextTV – CTV Commercials Deliver More Attention Than Other Digital Video Formats: https://www.nexttv.com/news/ctv-commercials-deliver-more-attention-than-other-digital-video-formats-research

- SiriusXM Media – CTV Campaigns Perform Better With Digital Audio: https://www.siriusxmmedia.com/insights/research-shows-ctv-campaigns-do-better-with-digital-audio

- Adlook – Why Socio-Demographic Data Fails: A Study Unveils Major Gaps in Accuracy: https://blog.adlook.com/blog/why-socio-demographic-data-fails-a-study-unveils-major-gaps-in-accuracy